What is Mutual Fund and how to buy?

Have you ever heard about what is a mutual fund? Do you know how this works? If not, today I will tell you about it.

Many people, just on hearing about them, make many imaginations in their mind and without knowing anything, think about it in the opposite direction.

Which is not right to do at all. That's why today I thought why don't you remove the misconception that is sitting in your mind about Mutual Funds today and make you aware of its truth.

There is a very good and easy way to earn money from mutual funds. It is not necessary that you have thousands of rupees to invest in this. Rather, you can also invest in it at the rate of only Rs 500 per month.

Many people consider Mutual Funds and stock/share market to be the same but it is not so at all.

Mutual fund and share market both are part of the market but there is a lot of difference between the two.

From today's post, we will know what is the difference between them and after all what is this mutual fund and how can we safely invest in it?Many people consider Mutual Funds and stock/share market to be the same but it is not so at all.

Mutual fund and share market both are part of the market but there is a lot of difference between the two.

From today's post, we will know what is the difference between them and after all what is this mutual fund and how can we safely invest in it?

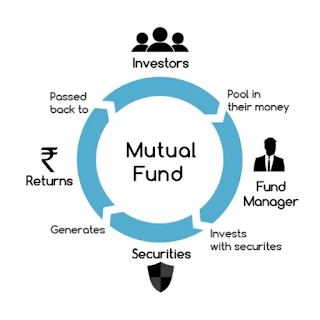

A mutual fund is a fund (collection) in which the money of many investors is mutually held together. This group of funds is managed to earn the highest possible profit.

Simply put, Mutual Funds are a fund made up of many people's money. In which the money invested is used to invest in different places and it is tried to give maximum profit to the investor from his amount.

The work of managing the fund is done by a professional person who is called a Professional Fund Manager.

The job of a professional fund manager is to look after the mutual fund and make more profit by investing the fund money in the right place. If put in simple words, its job is to convert the money invested by the people into profits.

Mutual Funds are registered under SEBI (Securities and Exchange Board of India) which regulates the market in India. The work of keeping investors' money safe in the market is done by SEBI. It is ensured by SEBI that any company is not cheating with the people. Mutual Funds have been present in India for a very long time, but even today people do not know much about it.

In the early times, people had the belief that Mutual Funds are only for the rich class. But this is not the case at all and in today's time this perception seems to be changing. The trend of people has increased towards Mutual Funds. In today's time, Mutual Funds are not only for the rich class.

Rather, any person can invest in Mutual Funds at the rate of only 500 ₹ every month. The minimum amount to invest in Mutual Funds is Rs 500.

The mutual fund industry in India began in 1963 with the formation of the Unit Trust of India (UTI) on India at the initiative of the Reserve Bank of India (RBI) and the Government of India.

Its main objective was to attract small investors and make them aware of the topics related to investment and market. UTI was formed in 1963 under an Act of Parliament. It was established by the Reserve Bank of India. And initially it worked under RBI.

In 1978, UTI was separated from RBI. Industrial Development Bank of India (IDBI) got regulatory and administrative control in place of RBI. And UTI started working under it. The development of Mutual Funds in India can be divided into several stages.

As the first phase was from 1964 to 1987, in which UTI had a fund of ₹ 6700Cr. After this the second phase starts from 1987, in which the entry of public sector funds started. In this time, many banks got a chance to make Mutual Funds.

SBI created the first NONUTI mutual fund. The second phase ended in 1993, but by the end of the second phase, the AUM ie Assets under management increased from ₹ 6700Cr to ₹ 47004CR. In this phase, there was a lot of enthusiasm among the investors in mutual funds.

The third phase started from 1993 and lasted till 2003. In this phase private sector funds were approved. In this phase, investors got more options of Mutual Funds. This phase ended in 2003.

The fourth phase started from 2003 which is going on till now. In 2003, UTI was divided into two separate phases. First SUUTI and second UTI mutual fund which used to work according to the rules of SEBI MF.

The effect of the 2009 economic recession was read on the whole world. Investors in India also suffered a lot. Due to this, people's confidence in mutual funds decreased a bit. But slowly this industry started coming back on track.

In 2016, the AUM was ₹15.63 trillion. Which was the highest ever. The number of investors is almost above 5 CR and lakhs of new investors are being added every month. This phase has proved to be golden for mutual funds.

There are many types of Mutual Funds. We can divide them into 2 categories.

First type of Mutual Funds on the basis of structure and second type of Mutual Funds on the basis of asset.

A) Types of Mutual Funds on the basis of Structure

1. Open ended mutual fund Open Ended Funds = In this scheme, investors are allowed to sell or buy funds at any point of time. There is no fixed date or period to buy or sell funds in this. These funds provide liquidity to the investors, hence they are very much liked by the investors.

2. Close ended Mutual Funds This type of plan has a stipulated maturity period and investors can buy funds only during the fund tenure. And such funds are also included in the share market. After this they are also used for trading.

3. Interval Funds This type of Mutual Funds is made up of both open ended funds and close ended funds. In this, the facilities of both the funds are primed. It allows investors to trade funds at pre-determined intervals. And trading of funds can be done on that fixed period. It was talked about the type of Mutual Funds on the basis of the structure, now we will talk about how many types of Mutual Funds are taken on the basis of asset.

B) Types of Mutual Funds by Asset

1. Debt funds Debt Funds = In this type of funds, the risk to the investor is very less. Investors invest in debentures, government bonds and other fixed income which are safe investments. Debt funds provide fixed returns. If you want a stable income then this fund is for you. If the investor's earnings from the funds are more than 10,000 then the investor has to pay tax.

2. Liquid Mutual Funds Liquid Funds = This is also a safe option to invest. Liquid funds invest in short term debt instruments. Therefore, if you want to invest for a short time, then liquid funds can be your choice.

3. Equity funds Equity Funds = If you want to get long term profits then Equity funds are for you. These funds invest in the stock market. These types of funds also involve risk, but the returns from them are more than others.

4. Money Market Funds Such funds provide reasonable returns for investors in the short term. It is invested in safe places.

5. Balanced Mutual Funds Equity fund and debt fund get a mixed benefit in this type of fund scheme. Funds accumulated in this type of mutual fund are invested in both equity and debt positions. These types of funds give investors stability in income on the one hand and on the other hand they also give impetus to income growth. Apart from these funds, there are many types of funds, but these are the main and most used funds.

By the way, you will find many such Android Apps in the market, using which you can easily invest in Mutual Funds.

Some of them are special like Groww, MyCams, InvesTap, KTrack Mobile App, IPRUTouch App etc.

At the same time, if you follow my advice, then you can use Groww Mutual Fund App. Because I am using this app for a long time and I have not had any problem till now.

Groww App (Android) : Sign Up Now Through this link, you will have to first sign up in the Groww App if you do not already have an account.

Whereas once you have created an account then you can easily invest money in Mutual Fund through this app.

Although there are many benefits of Mutual Funds, but today I will try to give complete information to you about the important benefits.

1. Professional Management The money you invest in Mutual Funds is managed by Mutual Fund experts with their experience and skills. Before investing this money, they collect information after doing thorough research of the fund in which the money is invested, if after that, according to the information collected by them, your money increases only then they invest.

2. Diversification The basic mantra of safe investing is that instead of putting your money in one place, divide it in many places and invest in many places. Every mutual fund invests the money in different places. A good fund can be invested not only in another company but also in another sector or maybe a company of a different size. Due to which the investors get maximum protection.

3. Variety There is something for every type of person in Mutual Funds today. There are all kinds of funds available for those seeking high returns, from maximum safe funds for those seeking maximum safe investments, with high returns. You wish to make any kind of investment, but it is possible that some mutual fund must have been created for you and it will sit according to your needs.

4. Convenience You can invest in Mutual Funds very easily. You can also withdraw money from the funds with the same ease. To invest, you have to fill a form which you can fill online or offline both from anywhere or from anywhere. After this you can sell or buy funds both online or offline. Along with having a lot of options in Mutual Funds, there are also a lot of facilities.

5. Affordable The share price of big companies is very high. Many times you want to invest money in those companies but you are not able to do so because of your budget. Whereas in Mutual Funds many people have money together, then your money is invested in big companies. And your money earns more profit there. Mutual funds are not only a way for large but also small investors to invest in large companies through Mutual Funds.

6. Tax Benefits Whenever you invest in the stock market, you have to pay tax for buying or selling shares. But in Mutual Funds you get tax exemption. In some funds, you do not have to pay any tax on your profits for some period. Tax exemption is also one of the reasons why they are becoming very popular. Before investing in Mutual Funds, collect all the documents and all the information related to the funds. You will be solely responsible for any damages.

How did you feel about Mutual Funds? Through this post, we have tried to provide you the information about Mutual Funds. We hope that you have liked this post of ours, then share it with your friends now and if there is any problem related to how to buy mutual funds or want information, then please write in the comment box so that we can help you in time. can try.

0 Comments